Introducing the Alliance Bank Virtual Credit Card that works just like a credit card but in a smarter way, in partnership with MCash.

Rewards

8x Three-year Bonus Points (TBP)

with e-Commerce transactions1

and eWallet top-up2

1x TBP

for all other transactions

No Annual Fee

TBP three (3) year validity period

Important Note

|

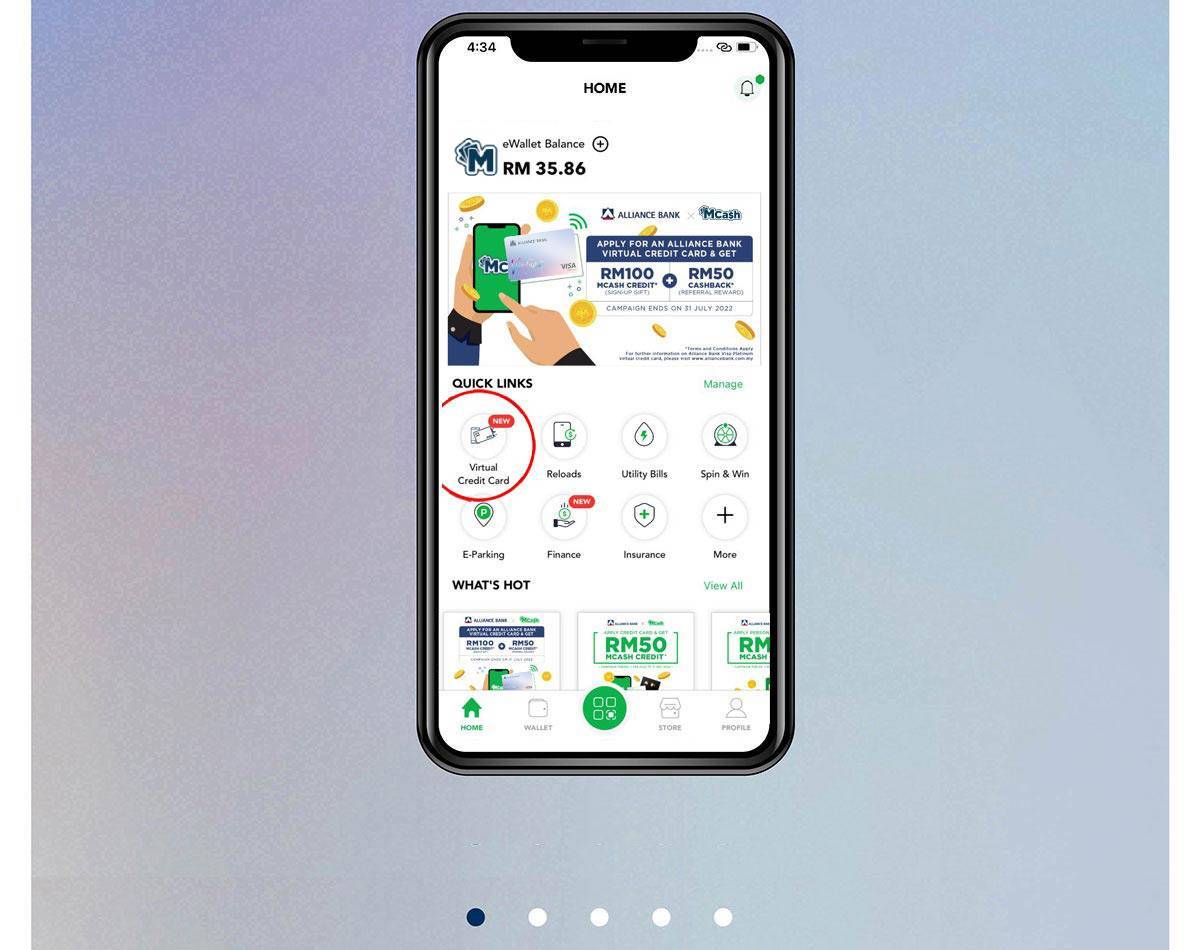

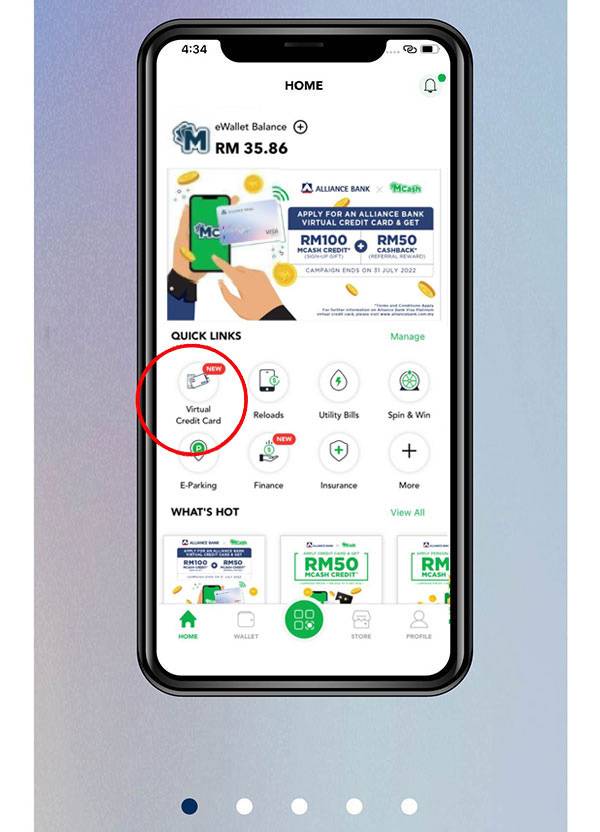

How to apply

Get your Virtual Credit Card in 3 simple steps.

1

Sign up for MCash account

Register for a new MCash Account via MCash Mobile App

2

Click on ‘Virtual Credit Card’ and scan your MyKad.

3

Upload your income documents.

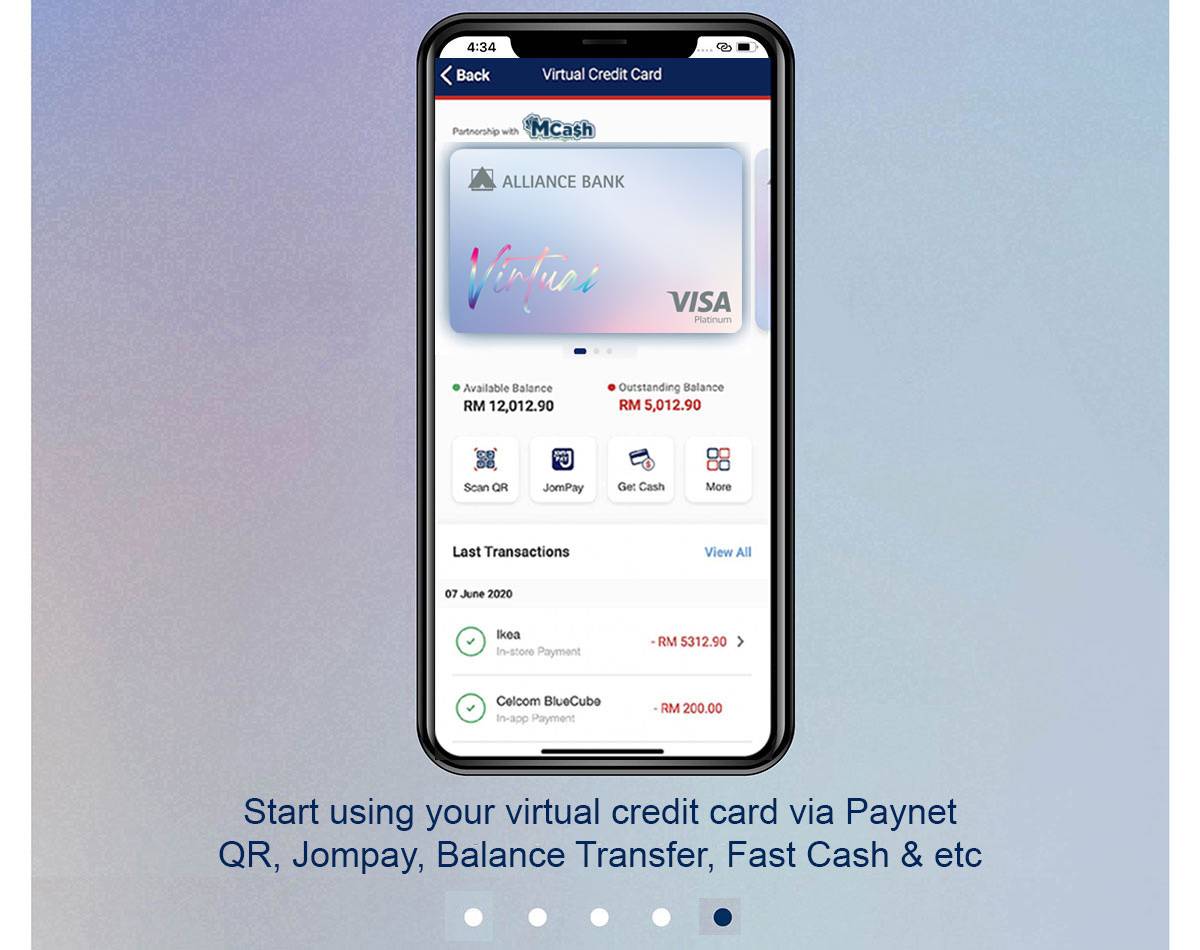

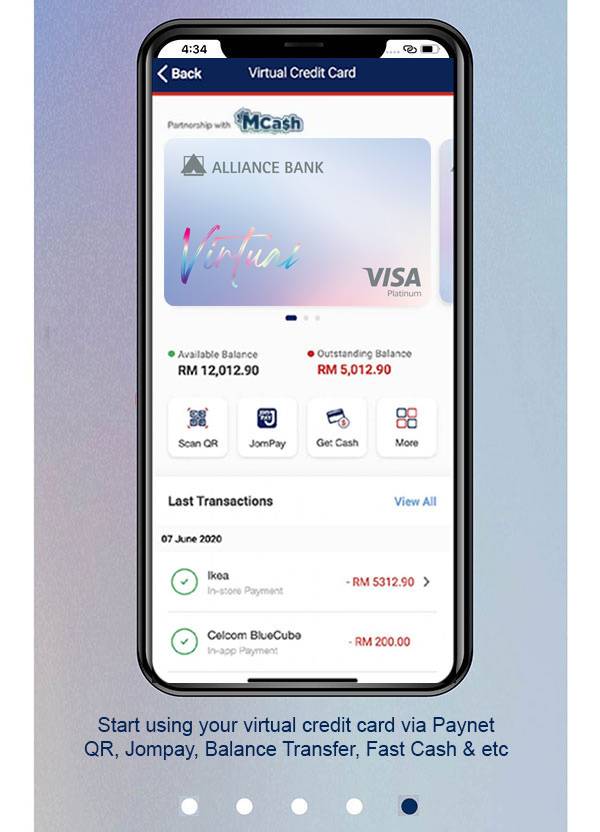

Once your Virtual Credit Card application has been approved, you can instantly enjoy a cardless shopping experience, perform online banking on the go and more.

Eligibility & Required Documentation

Who can apply?

- Principal Cardholders, 21 years old and above

- Annual Income of Minimum RM24,000 p.a.

Required Documentation

Salaried Earners

MNC/PLC/GLC

- Copy of NRIC (both sides) or a copy of a valid passport AND

- EPF (showing minimum latest 13 months' record printed from handheld or i-Akaun) OR

- Last 1 month payslip

Salaried Earners

Non MNC/PLC/GLC

- Copy of NRIC (both sides) or a copy of a valid passport AND

- EPF (showing minimum latest 13 months' record printed from handheld or i-Akaun) OR

- Latest 3 months' payslip & 3 months' bank statements

Self Employed

- Business Registration Certificate/Trading License/Form 9, Form 24, Form 49 AND

- Latest 6 months' bank statements OR

- Latest 1 Year Borang B and Tax receipt/e-Ledger

Awards and Recognition

Can't find what you're looking for?

Leave your details and we'll call at a time that works for you.