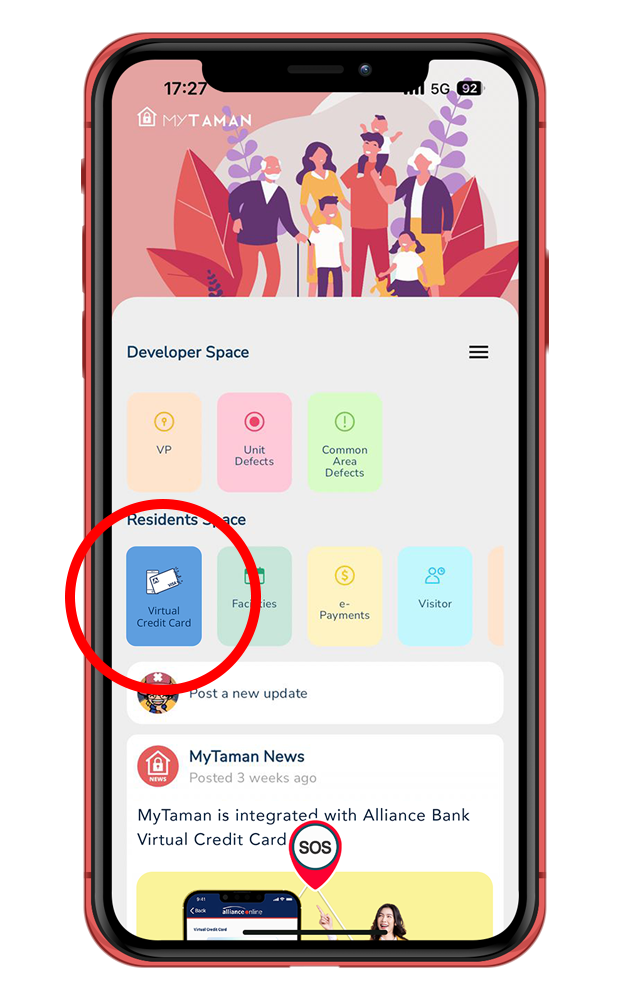

MyTaman introduces the Virtual Credit Card, offering secure transactions tailored to each resident’s needs and enriching community experiences

Benefits

- Malaysia’s 1st in-app Virtual Credit Card

- Secured Payment Tool

- Hassle-free Application

- Zero Annual Fee

Rewards

8x Timeless Bonus Points (TBP)*

with e-Commerce transactions1

and eWallet top-up2

1x TBP

for all other transactions

No Annual Fee

All Timeless Bonus Points Will Not Expire

Important Note

|

Sign up for MyTaman account

1

Register for a new MyTaman Account via MyTaman Mobile App

2

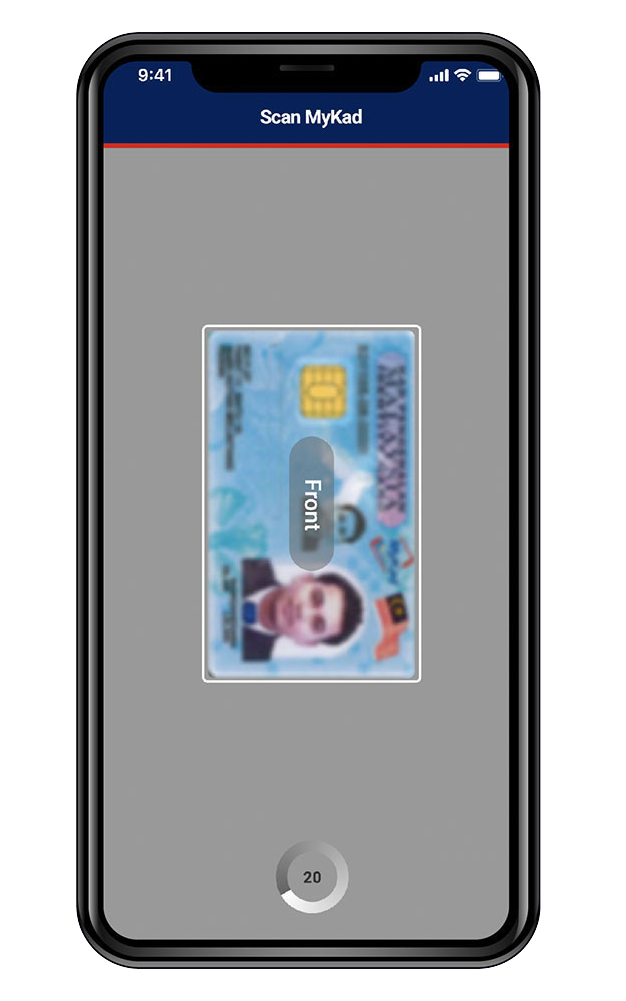

Click on ‘Virtual Credit Card’ and scan your MyKad.

3

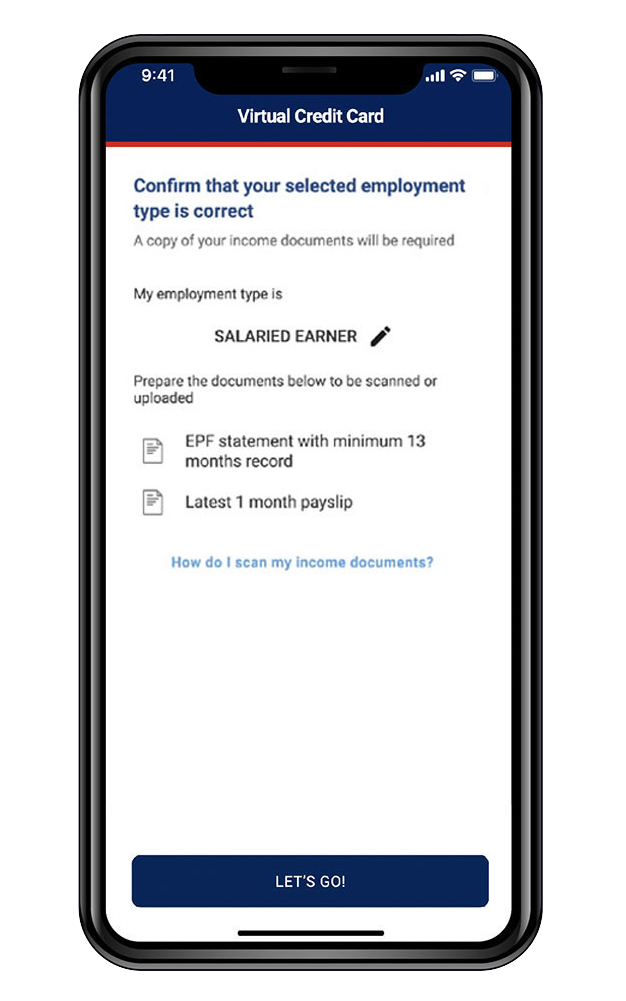

Upload your income documents.

Once your Virtual Credit Card application has been approved, you can instantly enjoy a cardless shopping experience, perform online banking on the go and more.

Eligibility & Required Documentation

Who can apply?

- Principal Cardholders, 21 years old and above

- Annual Income of Minimum RM24,000 p.a.

Required Documentation

Salaried Earners

MNC/PLC/GLC

- Copy of NRIC (both sides) or a copy of a valid passport AND

- EPF (showing minimum latest 13 months' record printed from handheld or i-Akaun) OR

- Last 1 month payslip

Salaried Earners

Non MNC/PLC/GLC

- Copy of NRIC (both sides) or a copy of a valid passport AND

- EPF (showing minimum latest 13 months' record printed from handheld or i-Akaun) OR

- Latest 3 months' payslip & 3 months' bank statements

Self Employed

- Business Registration Certificate/Trading License/Form 9, Form 24, Form 49 AND

- Latest 6 months' bank statements OR

- Latest 1 Year Borang B and Tax receipt/e-Ledger

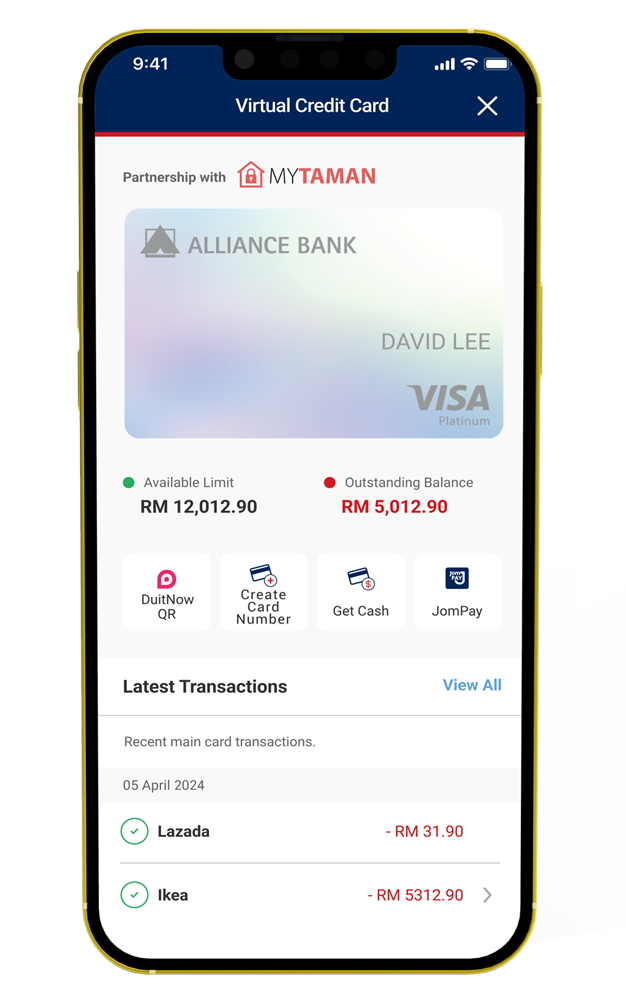

Introducing the Alliance Bank Visa Virtual Credit Card

Awards and Recognition

FAQs about Alliance Bank Visa Virtual Credit Card

The Alliance Bank Visa Virtual Credit Card (“VCC”) is a credit line provided by Alliance Bank Malaysia Berhad (“ABMB”). Functioning similarly to physical credit cards, a VCC is exclusively digital. Unlike a physical cards, a virtual card becomes available for customer use immediately after generating a random 16-digit number which changes every 30 minutes for security purposes. This virtual nature offers customers immediate usability while providing an additional layer of security by safeguarding information linked to bank accounts during one-off purchases.

Customers who are interested to apply for the VCC may follow the steps below:

- Download the allianceonline mobile app (‘AOM’) from the Google Play Store or Apple App Store.

- Tap on the VCC icon at the top right of the AOM login page.

- Proceed with the VCC application by providing personal and income details. Capture clear photos of your National Registration Identity Card (Front and Back) and upload supporting documents like an EPF statement or proof of income.

- Customers will receive the app push notification and SMS notification once a decision has been made on your application.

To be eligible for a Virtual Credit Card with Alliance Bank Malaysia, applicants must meet the following criteria:

- Principal Cardholders, aged 21 years and above

- Annual income of a minimum of RM24,000 p.a.

The documents required for Virtual Credit Card application are :

For Salaried Earners:

- Copy of NRIC (both sides)

- EPF (latest 13 months’ record)

For Self Employed or Commission based:

- Copy of NRIC (both sides)

- Business Registration Certificate Form 9/24/49

- Latest 6 months' bank statements OR

- Latest 1 Year Borang B and Tax receipt/e-Ledger

The credit limit for the Virtual Credit Card (VCC) is determined based on the customer’s income and their existing financing commitments during the application review by Alliance Bank. It ranges from a minimum of RM3,000 to a maximum credit limit of RM300,000.

Yes, you can apply for a VCC if you are an existing Alliance Bank Malaysia Credit Card holder. Please refer to the information above for details on how to apply.

VCC users will enjoy the following features:

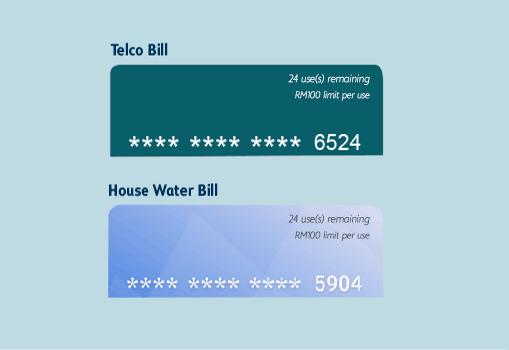

- Create a 16-digit Dynamic Card Number for online transactions and e-bill subscriptions

- Make JomPAY Bill Payments

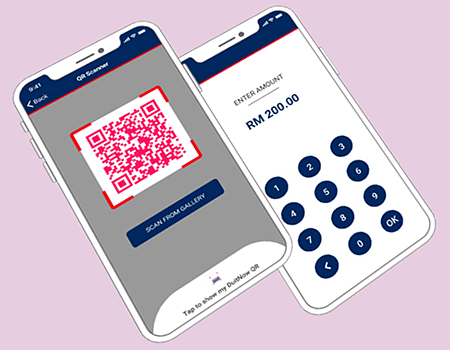

- Perform DuitNow QR payments at merchants accepting credit card payments via DuitNow

- Access Fast Cash

The Virtual Credit Card offers a range of valuable benefits, including:

Earn Timeless Bonus Points (TBP)

- 8x TBP for online shopping transactions and eWallet1 top ups

- 3x TBP for Dining

- 1x TBP for all other transactions

Note: All TBP will not expire

1For eWallet top-ups exceeding RM3,000 in each statement cycle, you will earn 1x TBP for every RM1 transaction.

No, there is no additional RM25 SST charge for creating a new Dynamic Card Number. The RM25 SST is only charged annually on your VCC Static Card. Any additional DCN created will not result in extra SST charges.

No, there are no annual fees for this Virtual Credit Card. However, there is a Sales Service Tax (SST) of RM25 imposed by the government.

Yes, there is a 0% Flexi-Payment Plan (FPP) available for a minimum spend of RM500 on the VCC until 31 December 2025.

The Virtual Credit Card offers enhanced security measures to protect users from online fraud:

- Customers can make seamless credit card payments on their mobile devices without the need for a physical card.

- Each transaction is assigned a unique 16-digit tokenization for security purposes, minimising exposure to the risk of fraudulent e-commerce transactions.

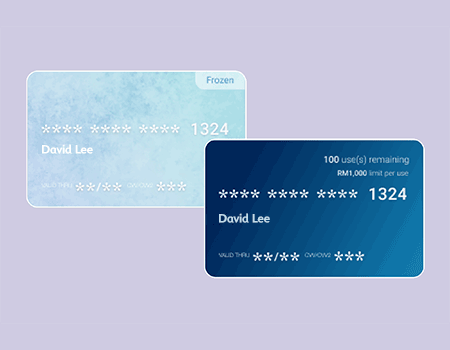

- Customers have the flexibility to freeze or unfreeze the virtual credit card without the hassle of calling the bank's contact centre, providing added control and security.

To facilitate the creation of one-time card numbers or setting up recurring/subscriptions via the Virtual Credit Card (VCC) for secure online transactions, you may refer to the educational link provided below:

https://www.alliancebank.com.my/Personal/Cards/VCC-AOM-How-to-UseThe Virtual Credit Card offers several customisable settings and features for user convenience:

| Subscription Card Settings | |

|---|---|

| View/Edit Card | Change the subscription details |

| Card Appearance | Change the style and card colour based on your preference |

| Freeze / Unfreeze Card | Temporarily block all transactions charged. This can be done if you encounter any suspicious transactions. You may also unfreeze the card on your own without calling the bank’s customer service. |

| Delete Card | For VCC cards you no longer need, you may delete them and they will be removed from your app. You will need to re-generate as new number if you wish to continue using VCC |

Yes, you can create a 16-digit card number specifically designed for subscriptions. You also have the flexibility to set the charge limit amount, the number of cards to be charged, and the expiry date.

You may refer to VCC’s “PRODUCT DISCLOSURE SHEET” by clicking on these link.

English:

https://www.alliancebank.com.my/Alliance/media/Documents/Cards/Personal/Credit-Cards/Credit-Card-Product-Disclosure-Sheet-PDS-EN.pdfBM:

https://www.alliancebank.com.my/Alliance/media/Documents/Cards/Personal/Credit-Cards/Credit-Card-Product-Disclosure-Sheet-PDS-BM.pdfVCC will only support those Duitnow QR Merchants that accepts line of credit.

To access your Virtual Credit Card statement, you can conveniently view your monthly statements through allianceonline.

To settle your outstanding Virtual Credit Card bill, you may choose from the following options:

Option 1: Login to the allianceonline mobile app, select 'Pay Card,' and choose Visa Virtual Credit

Option 2: Access your e-statement, refer to Virtual Credit Card account, and Pay via bank fund transfers

Virtual Credit Card operates on a single sign-on system. When you install and login to the Virtual Credit Card on a new device, the old device will be automatically logged out. This is because the new device is verified through a OneTime-PIN (OTP).

You can contact the Alliance Bank Contact Centre at +603-5516 9988. The contact centre is available every day from 8 am to 10 pm.

Can't find what you're looking for?

Leave your details and we'll call at a time that works for you.