Sales and Service Tax (“SST”)

Following the 2025 Budget announcement, the Malaysian Government will broaden the scope of Service Tax on financial services effective 1st July 2025. This expansion, focused on fee-based financial services, is part of wider tax reforms led by the Royal Malaysian Customs Department (“RMCD”) and the Ministry of Finance (“MoF”).

Alliance Bank Malaysia Berhad and its subsidiaries (“Alliance Bank”) are fully committed to adhering to the revised Sales and Service Tax (“SST”) framework. Starting 1st July 2025, we will implement an 8% Service Tax on a specified list of fee-based financial services, in accordance with the guidelines published on 9 June 2025 by the RMCD.

FAQs about Alliance Bank Malaysia's Sales and Service Tax

SST refers to the Sales and Service Tax, a consumption tax imposed by the Malaysian government. For financial services, the Service Tax applies at a rate of 8% to selected fee-based services and RM25 per year to credit card services. It is administered by RMCD. For more information regarding SST, please refer here.

The expanded scope of SST on financial services will take effect from 1st July 2025 onwards, in two (2) phases:

- Phase 1 (Effective 1st July 2025): The SST will apply to fees and charges on selected financial services (please refer to Appendix A for details).

- Phase 2 (Effective 1st October 2025 - or as otherwise directed by RMCD): RMCD, through industry associations and its updated guidelines on 17 September 2025, announced that the Phase 2 scope of SST – covering all remaining financial services not listed in Appendix A – will take effect from 1 October 2025.

Note: As the guidelines may be updated from time to time, we encourage customers to refer to the latest RMCD publications for the most up-to-date information on the key requirements and changes.

No. The following financial services are NOT subject to SST:

- Interest or profit charges

- Returns in the form of a spread

- Fees or charges that are punitive in nature

- Late payment charges on loans/facility;

- Charges for early withdrawal of fixed deposits;

- Compensation charge for dishonoured cheque;

- Overdraft excess fee; and

- Cancellation fees for terminating a contract before its expiry.

- Any basic banking services that incur fees or commission related to the operation of savings accounts, current accounts or similar accounts such as e-wallets.

- Deposit, withdrawal, payment or fund transfer;

- Issuance of debit card;

- Basic transaction over-the-counter;

- Basic transaction via Automatic Teller Machine (ATM); or

- Printing of account statements.

- Provision of financial services in connection with goods, land or matters outside Malaysia, but excluding outward remittance services where charges are imposed on customers located in Malaysia.

- Brokerage or underwriting services related to medical insurance or medical takaful covered by an individual.

- Fees related to Credit line facility services or shariah-compliant financing through the activation of a primary credit card, primary charge card, additional credit card or additional charge card.

- Provision of Islamic financial services with payment of service tax on fees charged in accordance with Shariah principles if they meet these conditions:

- They follow Shariah rules (Shariah-compliant).

- They support other Islamic financial services that are considered the main/core services.

- They are part of the main service structure — meaning they are needed to make sure the main Islamic service stays Shariah-compliant.

- The fees are unique to Islamic financial services and are not the same as fees charged for conventional (non-Islamic) services.

- The fees are bundled together with the main Islamic service and not charged separately by the provider.

- Provision of financial services to the Federal Government or State Government.

- Provision of financial services to local authorities (PBT) for the period of 1 July 2025 to 30 September 2025, after which they will no longer be SST exempt.

- Provision of financial services to another registered financial service provider for the furtherance of:

- taxable financial services;

- services related to the export of goods; or

- services related to goods, land or subject matter outside Malaysia, by the latter.

- Provision of financial services providers who act as a broker, on the clearance fees and trading fees charged by Bursa Malaysia in relation to transactions involving listed shares.

The following Alliance entities are SST registrants and will charge 8% SST on relevant financial services:

- Alliance Bank Malaysia Berhad - SST Registration No. W10-1808-32000842

- Alliance Islamic Bank Berhad – Registration No. W10-2203-32000079

- Alliance DBS Research Sdn Bhd – Registration No. W10-1808-32000931

The following Alliance entities are NOT SST registrants and will NOT charge 8% SST on relevant financial services:

- Alliance Direct Marketing Sdn Bhd – NA

- Alliance Group Nominees (Tempatan) Sdn Bhd – NA

- Alliance Group Nominees (Asing) Sdn Bhd – NA

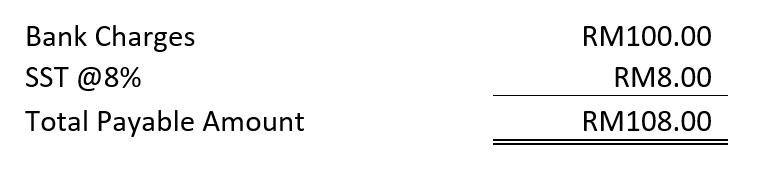

For fees subject to SST, the tax will be calculated at the rate of 8% on the applicable fee amount. For example:

Note: SST will be rounded to the nearest two decimal places, where applicable.

Before the implementation of the service tax scope expansion (i.e. before 1 July 2025), the following financial services were already subject to Service Tax:

- Insurance and takaful

- Credit or charge card

- Financial management services

- Financial consultancy/advisory services, including Corporate Advisory, Debt Capital Markets, and Equity Capital Markets

- Brokerage and underwriting services

- Digital financial services (currently granted an exemption by the Minister until 31 July 2025)

Only selected fee-based services will be subject to SST, as directed by the Royal Malaysian Customs Department (RMCD). This includes, but is not limited to:

- Loan and financing processing fees

- Card issuance or renewal fees

- Remittance charges

- Banker’s cheque issuance fees

For the full list of services subject to SST effective 1 July 2025 under Phase 1, please refer to the detailed schedule provided in Appendix A of the RMCD’s Service Tax Policy No. 1/2025 (Amendment No. 2) here.

No. The SST on credit cards remains fixed at RM25.00 per year, per card. No additional 8% SST will be applied to the annual fee.

No. Stamp Duty is a regulatory fee collected and remitted to Lembaga Hasil Dalam Negeri Malaysia (“LHDN”). As it is not considered a taxable service, it is not subject to SST.

Yes, SST is charged based on the actual amount payable after any promotional discounts. If a fee is reduced under a promotion, the 8% SST will apply to the discounted amount.

SST applies to digital banking services only if they involve chargeable fees, excluding those related to current / savings accounts or equivalent. For example, if a loan/facility processing fee is charged through digital channels, SST will apply.

SST will be shown as a separate line item following the applicable fee, ensuring transparency on the SST charged.

If the underlying fee is reversed or refunded, the corresponding SST will also be reversed accordingly

As a registered person under the Service Tax Act 2018, Alliance Bank is required to collect and remit the applicable tax to RMCD.

Yes. Services provided by the Labuan branch are subject to SST, as the branch is not regulated under the Labuan Financial Services Authority (“LFSA”).

Yes, if the taxable service is rendered in Malaysia and charged by a Malaysian-registered entity, SST may still apply even if you are located overseas.

Yes, Alliance Bank will continue to monitor RMCD guidelines and industry developments. Any updates to SST-applicable services or rates will be communicated accordingly.

This link brings you to a third party website, over which Alliance Bank Malaysia Berhad (ABMB) has no control. The use of the third party website will be entirely at your own risk, and subject to the terms of the third party website, including but not limited to those relating to confidentiality, data privacy and security.

ABMB gives no warranty as to the entirely, accuracy or security of the linked third party website or any of its content. ABMB shall not be responsible or liable in connection with the content of or the consequences of accessing the third party website.

By leaving https://www.alliancebank.com.my, ABMB's privacy policy ceases to apply.

Would you like to proceed?

Appendix A

LIST OF FINANCIAL SERVICES SUBJECT TO SERVICE TAX STARTING 1st JULY 2025

| No. | Types of Services |

|---|---|

| Conventional and Islamic banking or similar services | |

| 1. | Treasury Services or similar services

|

| 2. | Corporate Banking Services or similar services

|

| Investment Banking or similar services | |

| 3. | Debt Markets

|

| 4. | Equity Markets

|

| Other Services | |

| 5. | Any service that was subject to service tax before 1st July 2025 |