Personal Finance

5 Money Moves To Be Financially Empowered

28 September 2022

Here are five money moves you can make to be financially empowered.

1. Manage your money

The first step to financial empowerment is to manage your finances. This means having enough for emergencies, spending less than you earn and managing your debt wisely. Here’s how to start:

- Keep an emergency fund. Unexpected events, such as sudden job loss, can be expensive. Having an emergency fund can help you cover these costs until you get back on your feet again. Generally, experts suggest keeping aside an emergency fund that covers three to six months of living expenses. You’ll want to keep these savings somewhere where you can access them quickly, such as in a savings account that gives you interest.

- Have a budget. Having a budget and sticking to it helps you avoid overspending and keeps you on track to hitting your savings goals. A popular budgeting method is the 50/30/20 budget, in which you spend 50% of your income on needs (such as rent), 30% on wants (such as eating out) and save the remaining 20%. If you’re having trouble keeping to your budget, try setting up automatic bank transfers that transfer a portion of your income into a separate savings account every month.

- Pay off your debt. If you have high-interest debts, you’ll need a plan to pay them off. Decide how much you can afford to put aside every month to pay off your debts, and consider if you need to consolidate them under a personal loan/financing to save on interest/profit.

2. Invest for the future

Want to reach big financial goals such as early retirement or an overseas education for your child? Investing can help you achieve these goals. When you invest money in assets that generate income, your money grows faster For example, here’s how investing can help you grow your money:

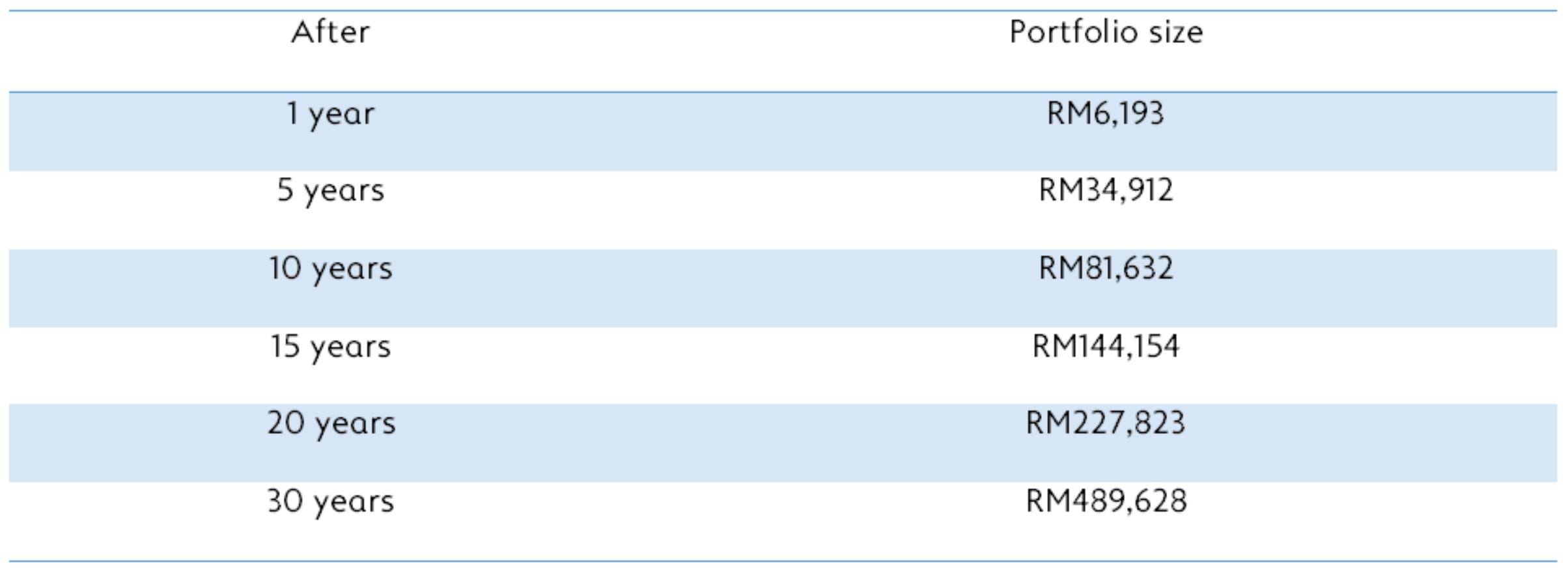

Investing RM500 a month for 6% annual return

In the example above, if you invest RM500 a month and receive a 6% return every year, you could potentially grow your portfolio to almost half a million ringgit after 30 years. On the other hand, if you did not invest at all, saving RM500 a month in the same period would only amount to RM180,000.

If you are new to investing, consider investments like unit trust funds and exchange-traded funds (ETFs). These investments pool money from many people to invest in a group of assets like stocks, bonds/sukuk or commodities. These are considered more beginner-friendly than investing directly in the stock market as they allow you to invest in many assets at once. This reduces the risk of large losses if one of the assets underperforms.

3. Increase your income

Having more income – or multiple sources of income – can help you pay down debt, manage everyday living costs and reach your financial goals faster. Here are a few ways you can bring in more money:

- Earn a raise at work. If you are a full-time employee, the most straightforward way to earn a higher income is probably to get a raise. This could mean picking up new skills or being more proactive at work to demonstrate your value to your employer.

- Look for a higher-paying job. If earning a raise at your current company doesn’t work, it could pay to look out for a new role elsewhere. Employees who switch jobs are more likely to be able to negotiate bigger pay raises.

- Start a business. Starting your own business (even if it’s just something on the side) can be a good learning experience, as well as a potential source of income. Businesses don’t always have to be huge, investor-funded projects either. You could start a small home-operated business (such as a web development company or one that sells home-baked goods) and grow from there.

4. Take an active role in your family's finances

If you've been leaving your household financial planning entirely to your spouse, consider taking on a more significant role. Being aware of where your household stands financially can help you and your partner work together to reach your family's financial goals. Here are a few things you can do:

- Be open with your partner. Sharing details about your savings, debts and spending patterns helps you both plan your household finances effectively.

- Set up a household budget. Just like a personal budget, allocating your household income helps your family avoid overspending.

- Decide how to share household expenses. If both you and your spouse earn an income, decide how each of you contribute to household expenses.

Share financial goals. Year-end vacations, child education or a new property purchase – being aligned with your spouse about your family’s financial goals means being able to prepare for these goals together.

5. Take advantage of great financial products

- Part of making better financial decisions is about taking advantage of great financial products. You can enjoy these benefits with Alliance Bank through these products. Get high savings rate with Alliance SavePlus/-i Account.

- Enjoy up to 8X Timeless Bonus Points with Alliance Visa Infinite Credit Card (yes, the reward points do not expire!) or up to 5% Cashback for all your retail purchases with Alliance Visa Signature Credit Card.

- Take advantage of affordable low interest/profit rates as low as 3.99% p.a. with Alliance Personal Loan/Financing when you have need for additional cash.

Financial empowerment is in your hands

If you've already taken these steps to improve your finances, that’s great! But if you haven't, that's okay – now's the time to start. Being financially empowered can be rewarding and should be part of every individual's journey. This article is adapted from iMoney's article.