Personal Finance

Why You Should Practice Regular Portfolio Rebalancing?

28 September 2022

The COVID-19 pandemic has bought a drastic change to the investment world, and how should an individual build and maintain his/her portfolio. With the increased market volatility, an investor may need to engage in more frequent portfolio rebalancing to ensure that the portfolio continues to be aligned with his/her desired return potentials and risk tolerance.

So what is portfolio rebalancing, and why should an investor consider it?

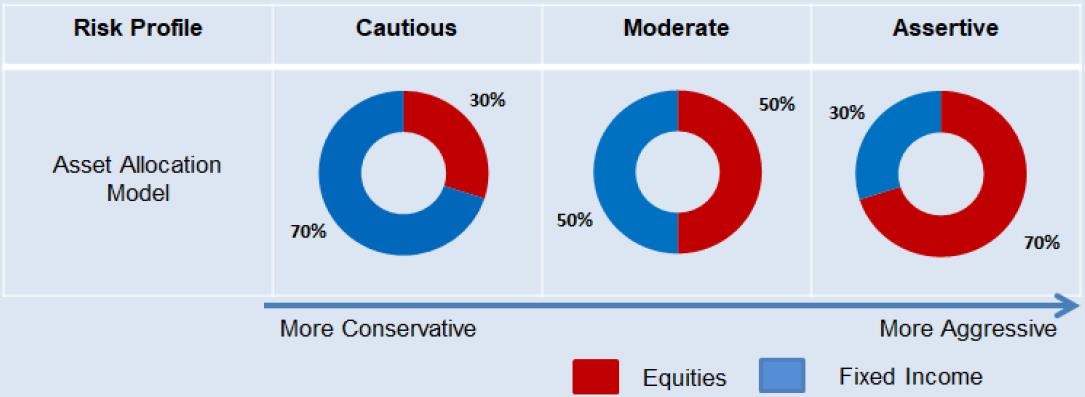

Portfolio rebalancing is an exercise of rebalancing the asset allocations in your portfolio. This is to ensure that your portfolio stays within your desired allocations (meeting your investment objectives and risk profile). The exercise is important because, over time, initial investment positions in the portfolio are affected by market movements. This is likely to change the weighting of the portfolio, which could increase undesired portfolio risk and cause overexposure in certain asset classes. When this occurs, a review and rebalance becomes necessary. Applying modern portfolio theory may be considered to ensure an optimally structured portfolio based on risk appetite. For instance, our bank has advocated an investor to have a balanced and diversified portfolio with appropriate allocations between equity and fixed income based on his/her risk profile, as illustrated below:

An investor with a moderate risk profile would have opted for a 50:50 allocation of equities and fixed income instruments. Nonetheless, the equities portion of the investor's portfolio could experience substantial appreciation over time. As a result, the allocation between equities and fixed income instruments is now 60:40. While the investor would be happy to see the value appreciation of its equities, the overall portfolio mix (60:40 equities: fixed-income allocations vs. an ideal target of 50:50) may no longer fit his/her risk profile. As such, it is better for the investor to (1) review the portfolio to see whether the current portfolio mix still suits his/her risk profile, and (2) rebalance the portfolio by reducing the investor's exposure to equities and/or increasing exposure in fixed income instruments, if it does not suit the investor's risk tolerance.

One question often being asked is how frequently a client should engage in portfolio rebalancing? A study by the Vanguard group shows that there is no optimal frequency or threshold for rebalancing. In Alliance Bank, we recommend our clients engage in portfolio review and rebalancing at least once a year. Nonetheless, significant global events and/or major market developments may require portfolio reviewing and rebalancing in addition to the regular duration.

The key benefits of regular portfolio rebalancing are highlighted below:

Successful investing requires us to follow our investment plan notwithstanding changes in market conditions. Regular portfolio rebalancing protects the investor from being overly exposed to undesirable risks. Therefore, a periodic review and rebalancing of the portfolio will ensure that the portfolio risk and target return are within the investor's comfort level.

Regular portfolio review and rebalancing also help investors understand and keep track of market developments and new investment themes. This process could be a fruitful experience for an investor that has a strong interest in gaining market insights.

Regular portfolio review and rebalancing provide opportunities for you to sell a portion of your winners and buy asset classes that have underperformed. This may seem counterintuitive, but no single asset could be a consistent top performer due to different market cycles. Therefore, regular portfolio rebalancing will help to impose investment discipline by (1) selling some of the outperformed assets that are getting too expensive while (2) buying the underperformed assets on the cheap with an increased likelihood to do well in the future.

Not only does the asset allocation of the portfolio changes over time, but our investment objectives could also change over time. For example, the investment objectives of a single adult could be vastly different when he/she marries a few years later and have kids. Engaging in portfolio review and rebalancing at least once a year not only ensures the portfolio continues to serve our investment objectives, it also presents an excellent opportunity for us to review or redefine our investment objectives if needed. This helps us to stay on track with our financial plans. In short, with the rising market volatility, we believe investors should engage in periodic portfolio rebalancing to ensure the portfolio continues to fit his/her risk and return profile. A rebalanced portfolio will ensure that the portfolio risk and target return are within the investor's comfort level. This makes it more superior to a buy-and-hold portfolio in times of high volatility.

- Aligning your potential risk and return.

- To keep abreast of the new investment themes and market developments.

- Portfolio rebalancing imposes investment discipline.

- An excellent opportunity to review your portfolio and investment objective.