Personal Finance

Stay Invested for the Long Term to Yield Good Returns

21 February 2023

Warren Buffet, considered one of the greatest investors of all time, has famously said, ‘only buy something that you would be perfectly happy if the market shut down for ten years. If you are not willing to own a stock for ten years, do not even think about owning it for ten minutes.’ Therefore, whether investors are investing for retirement or growing their savings, we always advocate for them to adopt a long-term investment horizon.

Why is it so important to invest with a long-term time horizon? A key reason is a long-term investing tends to provide better returns and minimise losses, as elaborated below.

It is known that financial markets are unpredictable and hardly move in a straight line given the price volatility. Therefore, market volatility is unavoidable when it comes to investing. Investors might ask, ‘What triggers the market volatility in the first place?’ Market volatility can be driven by a combination of factors such as economic data releases, geopolitical events, and/or investor sentiment, at any given time.

Some investors have tried to time the market, hoping to take advantage of the market volatility. Nonetheless, this could be a risky trading strategy that yields undesirable returns even for professional investors. Given that there are so many factors involved, nobody can persistently predict how the prices could change going forward. As such, short-term trading typically leads to poor long-term performance. This is because many investors who engage in short-term trading tend to give in to their emotions and subsequently makes unwanted investment decisions.

The most common mistake of investors is to let their fear control their investment decisions. Financial markets occasionally suffer from rapid and steep downturns. When asset prices are falling and the economic outlook is gloomy, not many investors could manage their fear and anxiety to avoid panic selling.

Nonetheless, Morningstar examines the ten-year expected returns for (1) individuals who stayed invested during the Great Recession in 2008, (2) individuals who got out of the market for a year, and (3) those who panicked and went to cash. The study concludes that ‘individuals who stayed invested during the Great Recession in 2008’ have achieved the highest return, as shown by the graph below.

This serves as an excellent illustration to us of how financial markets tend to reward long-term investors.

As such, it is imperative during periods of steep market sell down that investors do not succumb to their fear and dispose of their investment. Rather than focusing on the market downturn, investors should stay calm and focus on their long-term investment plan.

Understandably, the next question to ask is, ‘To what extent should investors stay invested amid market volatility?’ Although history does not always repeat itself and markets do not always go through a similar recovery cycle, empirical studies show that financial markets go up in the long term despite short-term volatility.

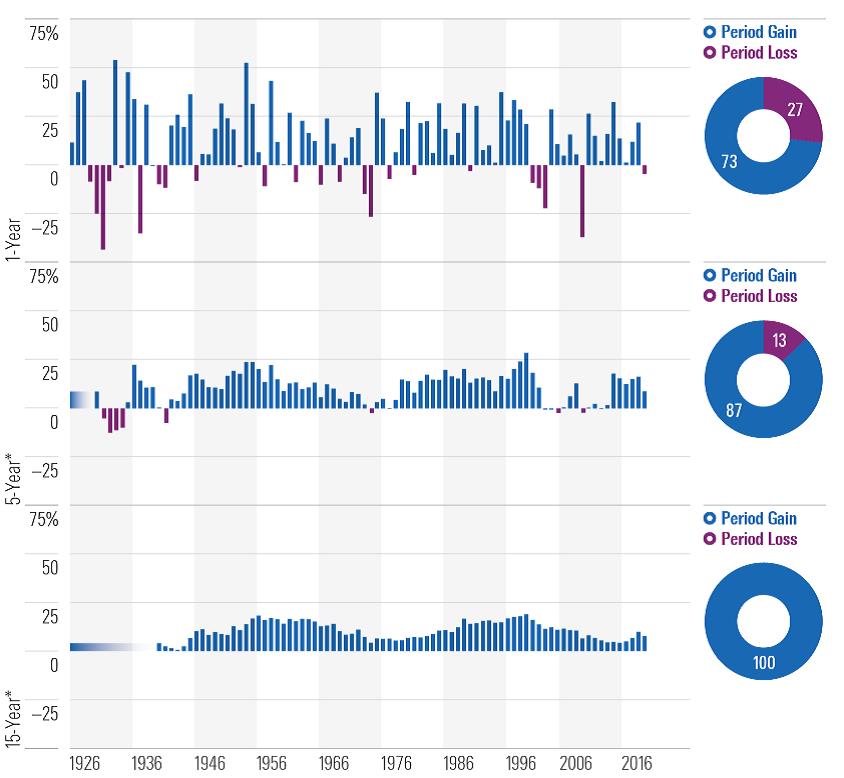

Morningstar has reviewed the annualised return of the stock market for one-, five-, and 15-year periods from 1926 to 2019. It shows that the risk of stock market loss is tremendously reduced when investors have a longer-term investment horizon. In fact, should investors hold for 15 years during the period between 1926 to 2019, the likelihood of losses reduced to ‘zero’.

This shows that staying invested for the long- term provides higher return potential as it increases the likelihood of positive returns. Therefore, it is crucial to engage in long-term investing. If investors are concerned about market downturns, they should instead diversify their portfolios.

As illustrated by the table below, different asset classes tend to perform differently under various market conditions due to their unique characteristics or relationships. For instance, gold was the top performer in 2020 with 25.1% return for the full year, while it was the worst performer in 2013 with -27.3% return. Meanwhile, MSCI emerging markets index (MSCI EM) was the best performer in 2017 with 37.8% return, but turned out to be the worst performer with -14.3% return next year (2018).

With portfolio diversification, if one asset class performs poorly over a certain period, other asset classes may perform better correspondingly, reducing the potential losses compared to concentrating all capital on a single asset class.

Therefore, it is essential to have a diversified portfolio by investing in different assets with low or no correlation to (1) reduce the volatility and investment risk of an investor's portfolio, (2) ensure better risk-adjusted returns, and (3) achieve a stable and sustainable return in the longer term.

So let's ignore the near-term market fluctuations and stay invested for the long term to reap good returns.