Designed to help SMEs start, grow and expand. Gain access to a wide range of business banking solutions and personalised advisory services.

A member of PIDM. Protected by PIDM up to RM250,000 for each depositor.

Every Aspect of Your Business is Covered with a Business Current Account

Enjoy these benefits when you open a business current account with us*

BizSmart® Online Banking

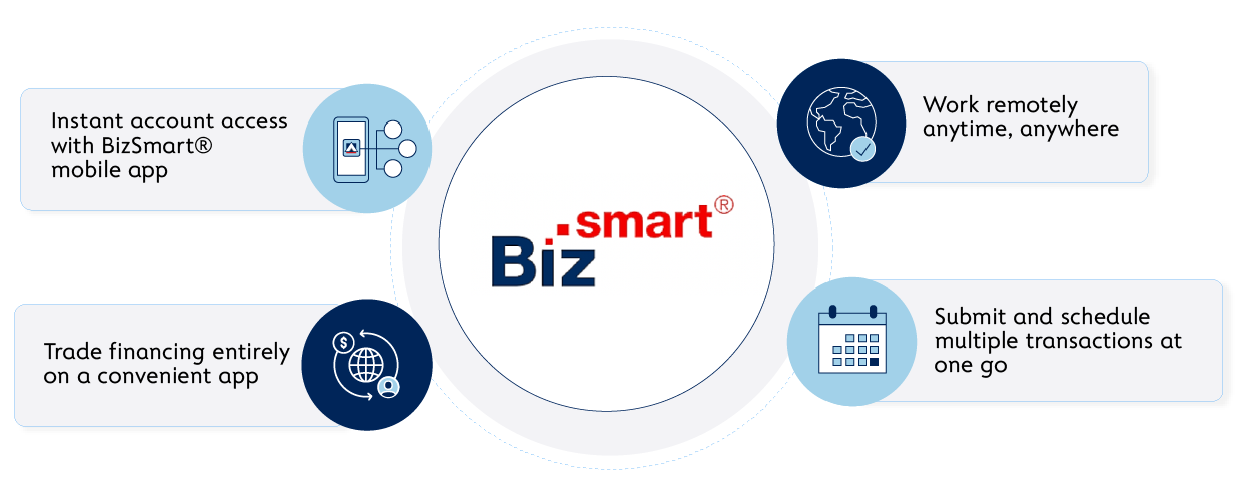

Faster and Easier Access with Alliance BizSmart®

- Instant access with BizSmart® Mobile app.

- Manage your trade financing with our award-winning eTrade

- Submit and schedule multiple transactions at one go.

- Use it anytime, anywhere.

alliance@work

Total Payroll Solution

- Day-to-day operation support.

- Attractive rates for deposit and financing needs.

- Complimentary on-site salary account opening saves your time and money.

BizSmart® Solution

Comprehensive solutions to elevate your business.

- Digitise your business for greater efficiency and productivity.

- Manage your operational costs effectively to optimise your profits.

- Generate more online sales.

- Develop and empower your employees.

- Tap into the halal market by getting your business halal certified.

Support Lokal

Expand Your Business Outreach

- Feature your business on our social media.

- Reach new audiences, get new customers.

- Increase your digital exposure with marketing opportunities.

- Connect with SMEs and local communities to build valuable relationships.

Get exclusive fee waivers when you sign up for Alliance BizSmart® Online Banking

| Charges on Alliance BizSmart® Online Banking | |||

|---|---|---|---|

| Inquiry Only | Transactional | ||

| SOLE PROPRIETOR | Free | RM5 | |

| SME / OTHERS | Free | RM30 | |

| If you sign up online AND meet the waiver criteria T&Cs* |

Monthly Subscription Fee is WAIVED* | ||

Waiver criteria T&Cs: Minimum 10 successful e-payments monthly, or maintain RM50,000 (for SME) and RM30,000 (for sole proprietor) average monthly current account balance or overdraft utilisation.

If the current month waiver criteria are not met, the Bank will charge the BizSmart® monthly subscription fee and transaction fee for the current month in the following month.

Other Banking Products for SMEs

Digital SME Express Financing

Fast, simple and convenient business loan at your fingertips, collateral-free financing up to RM500,000.

Apply Now Learn moreDigital SME Cash Flow Financing

Collateral-free working capital financing up to RM1,000,000.

Apply Now Learn moreBusiness Premises Financing

Finance commercial properties or refinance existing properties with flexible loan tenures and high financing margin.

Apply Now Learn moreMore Information

FAQs about Alliance Business Current Account

- Business entities: Sole proprietor or/ Sdn Bhd with 2 or 3 directors; and

- Malaysian company registered with Suruhanjaya Syarikat Malaysia (SSM). Note: SSM report must be updated with the latest list of business owner(s)/ partners/directors/shareholders; and

- Applicant/partners/business owner(s)/director(s) MUST be citizen(s) of Malaysia and hold the latest MyKad (with dual image/version 80k); and

- Applicant/partners/business owner(s)/director(s) MUST have an individual Malaysian online banking account in another bank with DuitNow function; and

- Businesses that do not have an existing Business Current Account in Alliance Bank / Alliance Islamic Bank with BizSmart® online banking access.

- MyKad with dual image / version 80k

- Account Opening and BizSmart® Board Resolution (PDF Scanned in colour)

- Memorandum & Articles of Association / Constitution (This document is by default optional, but is mandatory if your company is incorporated prior to 31 January 2017)

- All directors/ business owners hold a MyKad with dual image / version 80k

- Complete the web form here.

- Once submitted, you will receive an email to download Alliance BizSmart® App with your application reference number.

- Launch the Alliance BizSmart® App, click on Start eKYC button. Enter the application reference number and business registration number to perform eKYC.

- Once your eKYC verification has passed, you will receive a notification of the account details of your newly created Business Current Account.

- To activate the account, please perform fund transfer of RM500(Sole Proprietor) & RM5,000 (Sdn Bhd) via DuitNow from your personal bank account with another bank within 30 calendar days. The account will not be activated and not ready to be used if the fund transfer is not performed. The account will be deactivated after 30 calendar days without any activity.

- Kindly check in your spam/junk folder.

- Please contact our contact centre hotline at 1-300-80-3388 / 03 5624 3888 for assistance.

(Operating hours: Mon - Fri: 9am - 6pm)

(Operating hours: Mon - Fri: 9am - 6pm)

The main applicant may also receive a phone call from a Bank personnel.

To open an Islamic Business Current Account, please fill in this form and our Relationship Manager will contact you within 3 working days.

IOS – 14.0.0 and above

Android – 11.0.0 and above