e-Invoicing

In response to the implementation of the e-Invoicing by the Inland Revenue Board of Malaysia (IRBM*), Alliance Bank (“Alliance Bank Malaysia Berhad” or “the Bank”) and its subsidiaries are committed to complying with all established requirements and guidelines by the Inland Revenue Board of Malaysia.

To ensure our vendors are well-informed, the Bank will provide essential information related to e-Invoicing. This includes the Taxpayer Identification Number (TIN), Service Tax (SST) number, Malaysian Standard Industrial Classification (MSIC), and other relevant details for all Malaysian incorporated entities of the Bank that are subject to e-Invoicing.

| Name of Entities | Taxpayer Identification Number (TIN) |

New Business Registration Number (BRN) |

Malaysian Standard Industrial Classification (MSIC) | Service Tax (SST) Number |

|---|---|---|---|---|

| Alliance Bank Malaysia Berhad | C2880423060 | 198201008390 | 64191 | W10-1808-32000842 |

| Alliance Islamic Bank Berhad | C20099891090 | 200701018870 | 64192 | W10-2203-32000079 |

| AllianceDBS Research Sdn Bhd | C3869476100 | 198401015984 | 73200 | W10-1808-32000931 |

| Alliance Direct Marketing Sdn Bhd | C868830030 | 197201001179 | 66199 | Not Applicable |

| AllianceGroup Nominees (Tempatan) Sdn Bhd | C892871010 | 197801005218 | 64993 | Not Applicable |

| AllianceGroup Nominees (Asing) Sdn Bhd | C5872941000 | 199301018121 | 64993 | Not Applicable |

If you have any inquiries or require further information related to e-Invoicing, kindly contact your point-of-contact for the procurement of the goods and services.

*IRBM also known as Lembaga Hasil Dalam Negeri (LHDN)

FAQs about Alliance Bank Malaysia's e-Invoicing

An e-Invoice is a digital representation of a transaction between a supplier and a buyer. E-Invoice replaces paper or electronic documents such as invoices, credit notes, and debit notes. E-Invoice is issued by the supplier to the buyer and acts as proof of income for the seller and as a proof of expense for the buyer. For more information regarding e-Invoice, please refer here.

No, the issuance of e-Invoice is not only limited to transactions within Malaysia. It is also applicable to all transactions carried out by you, including cross-border transactions such as money remittance.

E-Invoice is a document that has been validated by the Inland Revenue Board of Malaysia (LHDN) and includes a QR code as proof of validation. This QR code is included in the PDF version of e-Invoice that will be issued by Alliance Bank Malaysia Berhad and its subsidiaries (“Alliance Bank”) starting July 2025.

There will be no changes to your current annual or monthly statement. E-Invoice is an additional document that will be issued by Alliance Bank to comply with the e-Invoicing requirements administered by LHDN.

Yes, you can continue to claim tax deductions or personal tax relief using existing documentation (such as statements) provided by Alliance Bank as a proof of expense incurred by you, until such time the legislation has been amended.

An e-Invoice is issued by Alliance Bank (as a supplier) to you as proof of your expense to substantiate a particular transaction for tax deduction/relief purposes.

A self-billed e-Invoice is issued by Alliance Bank (as a Buyer) and assumes the role of the supplier for submission to LHDN for validation. This would allow Alliance Bank to use the validated self-billed e-Invoice as a proof of the Alliance Bank's expense for tax purposes. For more information regarding e-Invoices, please refer here.

Tax Identification Number (TIN) or Nombor Cukai Pendapatan is a unique number assigned to persons (individual, corporate or body of corporate) by LHDN. It is issued to facilitate reporting of income tax by taxpayer to the Director General of Inland Revenue.

The TIN is unique to a person. TIN is usually issued either on request, on registration exercise by the tax authority or on employment when their employer request for their registration.

For Non-Individual TIN (with prefix other than IG):

- If you have obtained the latest version of TIN provided after 1 January 2023, please do not include the additional zero “0” at the back of the TIN (e.g. C96000000XX).

- If you are using the older version of TIN that was provided before 1 January 2023, please include the additional zero “0” at the back of the TIN number (e.g. C96000000XX0).

- Please note that Non-Individual TIN always ends with zero “0”.

For Individual TIN (with prefix IG):

- The numeric character within the TIN remains the same (at a maximum of 14 characters including prefix).

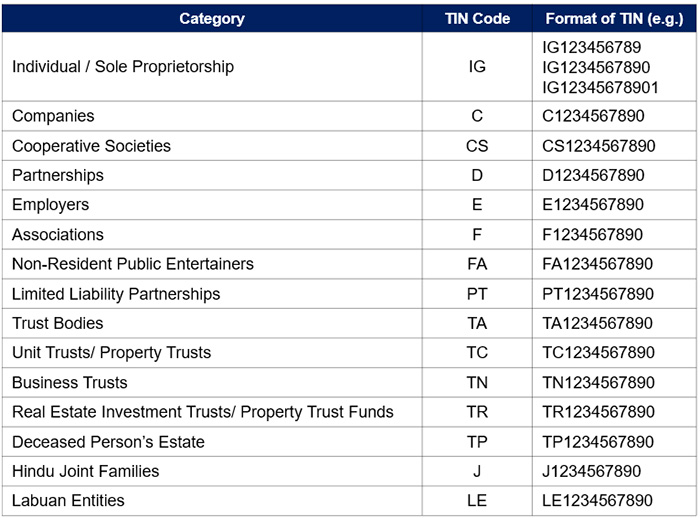

General format of TIN (Source: malaysia-tin.pdf):

- Must start with 1 or 2 alphabets (i.e. C, IG, E, FA)

- Followed by 9 – 13 numeric characters

- No spacing and special characters

Yes, non-Malaysians will also be assigned with a TIN if they are a registered taxpayer with LHDN.

Alliance Bank is collecting Tax Identification Numbers (TIN) as part of our commitment to comply with regulatory requirements, specifically in alignment with the implementation of e-Invoice by the LHDN.

The e-Invoice initiative aims to streamline tax processes and enhance efficiency in tax administration by enabling near real-time validation and storage of transactions. Providing your TIN ensures accurate reporting and compliance with e-Invoicing requirements.

Yes, providing your TIN is mandatory if you require an e-Invoice to be issued to you.

Your TIN will be treated with the utmost confidentiality and will not be shared with third parties except as required by law or with your explicit consent in compliance with Section 133 of the Financial Services Act (FSA) and Section 145 of the Islamic Financial Services Act (IFSA).

Registered taxpayers can find their TIN:

- On the front page of their individual income tax return

- Login to the MyTax Portal under the ‘e-Daftar’ menu

- Contact the HASiL Contact Centre (03-8911 1000)

- Visit the nearest LHDN office.

The Sales and Service Tax (SST) number is a unique identifier assigned to persons registered with the Royal Malaysian Customs Department.

General format of SST:

- Must start with 1 alphabet (i.e. A,B,W)

- Followed by 2 numeric characters and a ‘-‘

- Followed by 4 numeric characters and a ‘-‘

- Followed by 8 numeric characters

Example: A01-2345-67891012

Malaysian taxpaying businesses can check SST Registration Number through MySST Portal under “Registration Status” MySST

Only non-individual entities may have the possibility of having two SST Registration Numbers. Examples include:

Car Manufacturer:

- Sales Tax: For manufacturing and selling products.

- Service Tax: For providing repair and maintenance services.

Based on LHDN's requirements, these details are required to be submitted to LHDN along with the other e-Invoice fields for validation to generate an e-Invoice.

The SST Registration Number is only mandatory for SST registrants. Please be assured that this information will be used strictly for e-Invoicing purposes and will not be shared with any other parties.

Yes, when you request for an e-Invoice to be issued, you are required to provide the relevant details to Alliance Bank (as indicated in the LHDN e-Invoice guideline version 3.2) for the purpose of issuance of e-Invoice.

LHDN requirements for the buyer's/customer's information that are mandatory to issue an e-Invoice are as follows.

- Name

- Business Registration Number (BRN) / Identification Number (NRIC) / Passport Number

- Tax Identification Number (TIN)

- Sales & Service Tax Registration Number (SST)

- Mailing Address

- Email address (Optional)

- Contact Number

You can submit your information through the following channels.

- Mobile App/Portal

- Relationship Managers (RMs)

- Visiting your nearest ABMB branch

- Contacting our Customer Service Center

- Consumer Banking: 03-5516 9988

- Business Banking: 1-300-80-3388

Yes, you can still provide your information. However, should the submission approach the compulsory implementation date of 1 July 2025, Alliance Bank cannot assure but will strive diligently to issue the e-Invoice promptly.

You will not be issued an e-Invoice prior to the submission of mandatory customer information. The e-Invoice will only be made available in your next statement cycle, after you have submitted the mandatory information.

If the mandatory information submitted by you is incomplete or incorrect, LHDN may reject your e-Invoice during validation process. Consequently, Alliance Bank will not be able to issue a validated e-Invoice to you.Therefore, you must ensure that you provide a valid TIN and other details accurately for Alliance Bank to submit the e-Invoice to LHDN for validation, so that e-Invoice can be issued to you.

Alliance Bank will be transitioning to e-Invoices in phases beginning 1st April 2025 and if you are registered with LHDN’s MyInvois Portal, you will receive notifications from LHDN following any successful e-Invoice submissions.

However, e-Invoices will only be available to you gradually starting in July 2025.

Since there will not be individual e-Invoice issued to you until 1 July 2025, please continue to use the existing documentation provided by Alliance Bank to substantiate your proof of expenses.

Customers can access their e-Invoices conveniently through self-service channels, including Alliance Online Mobile (AOM), Alliance Online Personal (AOP), and BizSmart, starting July 2025, in alignment with the LHDN-mandated implementation date.

For those who do not have access to AOM, AOP, or BizSmart, registration for these platforms is required to access e-Invoices. Once registered, e-Invoices will be available for customer self-service retrieval.

Alternatively, customers who do not wish to register for these channels may request for their e-Invoice by visiting any Alliance Bank branch or contacting the Alliance Bank Contact Centre.

Please note: e-Invoices will only be issued once all required personal details have been provided.

Multiple e-Invoices may be issued to you if you use multiple banking services and depends on the mode of receiving bank statements. For example:

- If you use multiple facilities such as credit cards, loans, and deposits, you will be issued multiple e-Invoices.

Alliance Bank will issue the e-Invoice to the primary/principal account holder.

This link brings you to a third party website, over which Alliance Bank Malaysia Berhad (ABMB) has no control. The use of the third party website will be entirely at your own risk, and subject to the terms of the third party website, including but not limited to those relating to confidentiality, data privacy and security.

ABMB gives no warranty as to the entirely, accuracy or security of the linked third party website or any of its content. ABMB shall not be responsible or liable in connection with the content of or the consequences of accessing the third party website.

By leaving https://www.alliancebank.com.my, ABMB's privacy policy ceases to apply.

Would you like to proceed?