10 June 2024

Revision of Alliance Bank Business Credit Cards Features

Announcement

Dear Valued Cardholders,

We wish to inform you that Alliance Bank Business Credit Cards features have been updated as follows. The updated features shall be effective from 1 July 2024.

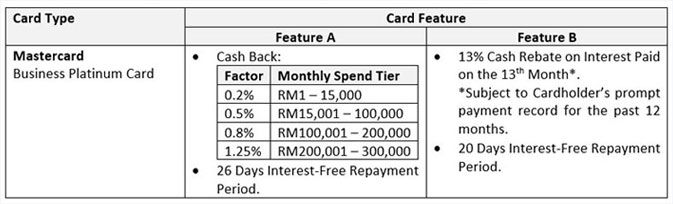

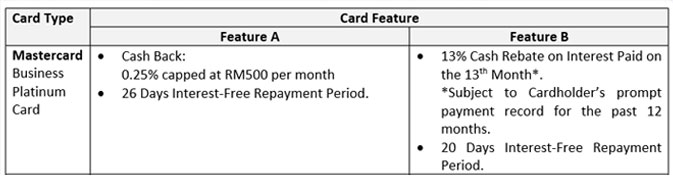

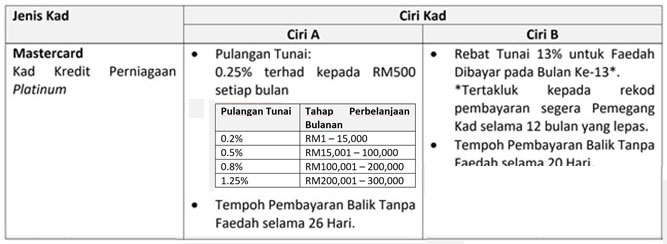

Card Type: Mastercard Business Platinum Card

Existing Features

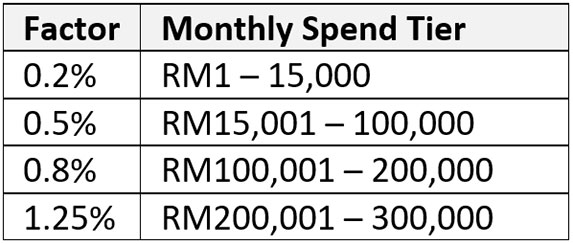

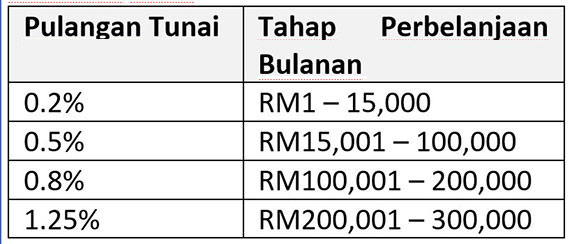

Feature A:Cash Back  |

Feature B:• 13% cash rebate on interest paid • 20 days interest-free repayment period |

Other Benefits

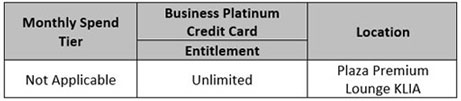

- Unlimited complimentary KLIA Plaza Premium Lounge Access

- Principal: RM438 (Personal Liability); No Charge (Corporate Liability)

Nominee/Supplementary: RM188 (both Personal and Corporate Liability)

New Features effective 1 July 2024

| Feature A:• 0.25% cashback, capped at RM500 per month • 26 days interest-free repayment period |

Feature B:• 13% cash rebate on interest paid • 20 days interest-free repayment period |

Other Benefits

- No Complimentary Travel Lounge Access

- Principal: RM438 (Personal Liability); No Charge (Corporate Liability)

- Nominee/Supplementary: RM188 (both Personal and Corporate Liability)

The Business Credit Card Product Disclosure Sheet has also been revised and will be effective from 1 July 2024 onwards.

Existing Clause

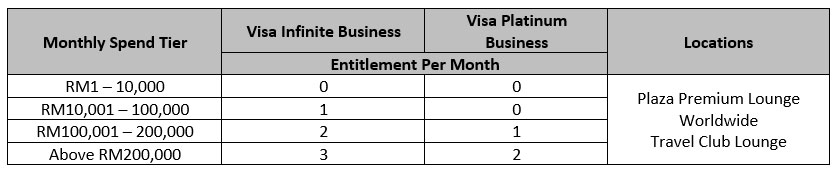

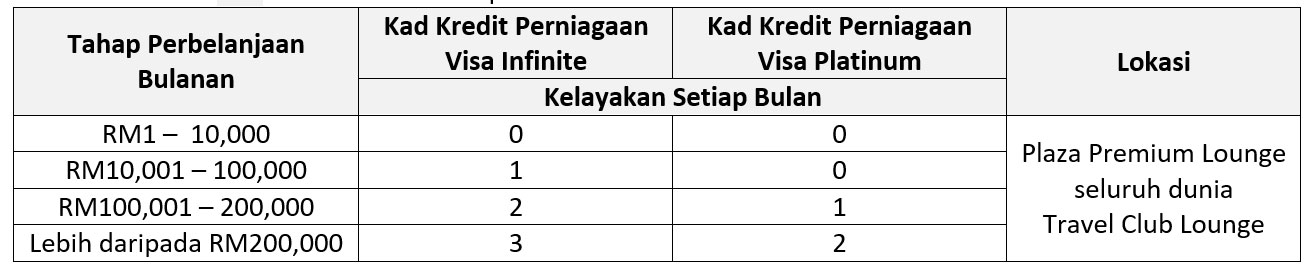

Complimentary Lounge Access

- Complimentary Lounge Access is applicable to Visa Infinite Business Credit Cardholders, Visa Platinum Business Credit Cardholders and Business Platinum Credit Card.

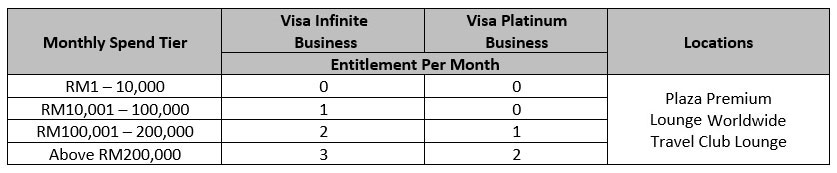

- The details of the Complimentary Lounge Access are as follows:

- The Complimentary Lounge Access for Visa Infinite Business is capped at 9 times at Plaza Premium Lounge and 9 times at Travel Club Lounge per calendar year.

- The Complimentary Lounge Access for Visa Platinum Business is capped at 6 times at Plaza Premium Lounge and 6 times at Travel Club Lounge per calendar year.

- Cardholders may carry forward their unutilised entitlement to the subsequent months, subject to the total capping per calendar year.

- In the event the Cardholders utilise the entitlement but do not meet the stipulated monthly spend tier (based on statement balance) and/or exceed the total capping per calendar year, the Bank will charge the Cardholders USD30 per entry for Plaza Premium Lounge utilisations and/or RM131 per entry for Travel Club Lounge utilisation. This charge will be reflected in the respective Cardholders statement within 2 statement cycles from the date of the lounge access utilisation.

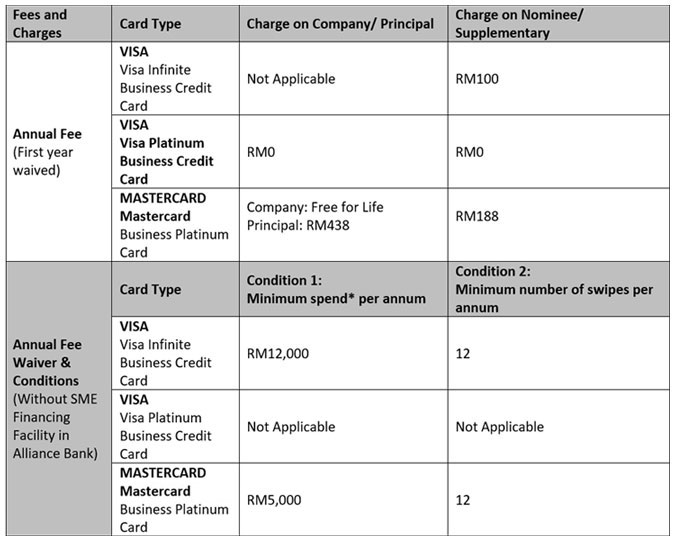

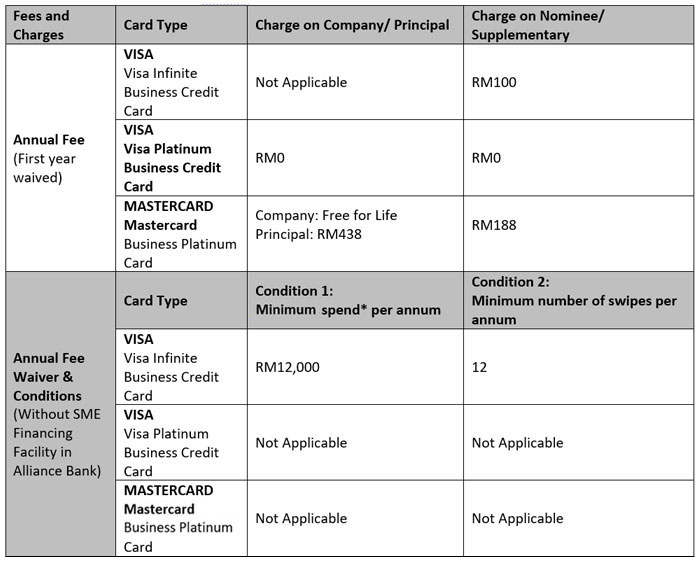

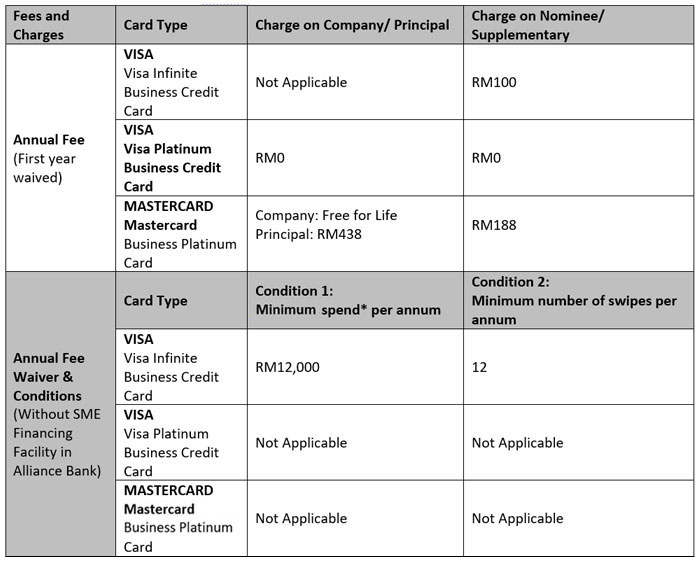

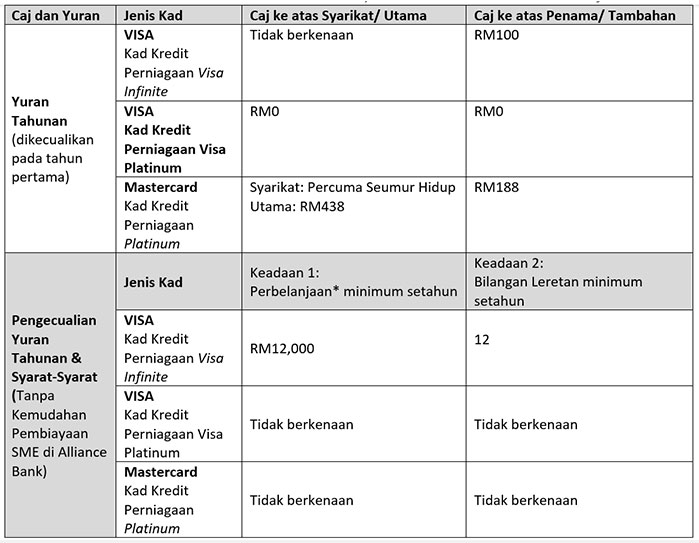

5. What are the fees and charges I have to pay?

New Clause effective from 1 July 2024

Complimentary Lounge Access

- Complimentary Lounge Access is applicable to Visa Infinite Business Credit Cardholders and Visa Platinum Business Credit Cardholders only.

- The details of the Complimentary Lounge Access are as follows:

- The Complimentary Lounge Access for Visa Infinite Business is capped at 9 times at Plaza Premium Lounge and 9 times at Travel Club Lounge per calendar year.

- The Complimentary Lounge Access for Visa Platinum Business is capped at 6 times at Plaza Premium Lounge and 6 times at Travel Club Lounge per calendar year.

- Cardholders may carry forward their unutilised entitlement to the subsequent months, subject to the total capping per calendar year.

- In the event the Cardholders utilise the entitlement but do not meet the stipulated monthly spend tier (based on statement balance) and/or exceed the total capping per calendar year, the Bank will charge the Cardholders USD30 per entry for Plaza Premium Lounge utilisations and/or RM131 per entry for Travel Club Lounge utilisation. This charge will be reflected in the respective Cardholders statement within 2 statement cycles from the date of the lounge access utilisation.

5. What are the fees and charges I have to pay?

Thank you.

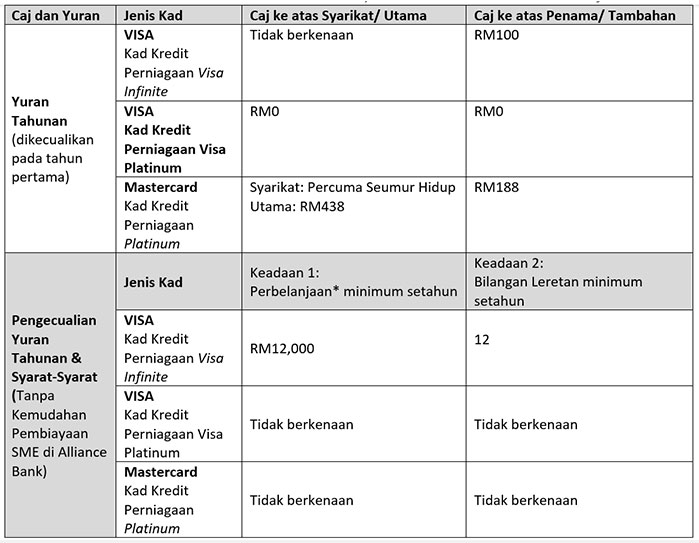

Pindaan Ciri-ciri Produk Kad Kredit Perniagaan Alliance Bank

Pemegang Kad yang Dihormati,

Kami ingin memaklumkan bahawa ciri-ciri Produk Kad Kredit Perniagaan Alliance Bank telah dikemas kini seperti berikut. Ciri-ciri yang dikemas kini akan berkuat-kuasa mulai 1 Julai 2024.

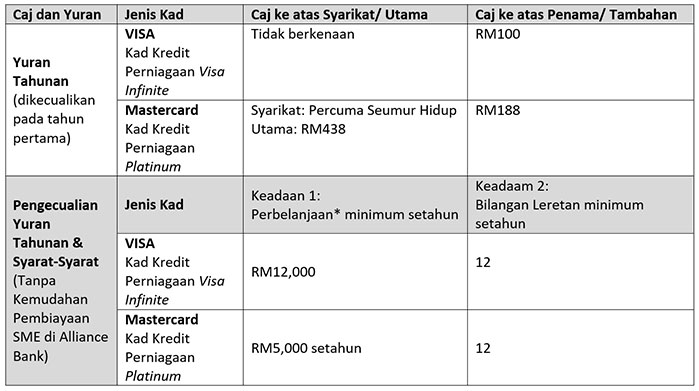

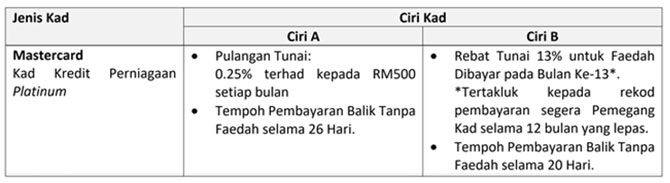

Jenis Kad: Kad Business Platinum Mastercard

Ciri-ciri Sedia Ada

Pilihan A:Pulangan tunai  |

Pilihan B:• Rebat Tunai 13% untuk Faedah Dibayar • Tempoh pembayaran balik tanpa faedah 20 hari |

Kemudahan Lain

- • Akses percuma tanpa had untuk Plaza Premium Lounge KLIA

- Utama: RM438 (Liabiliti Persendirian); Tiada Caj (Liabiliti Korporat)

Penama/Tambahan: RM188 (Kedua-dua Liabiliti Persendirian dan Liabiliti Korporat)

Ciri-ciri Baharu berkuat kuasa 1 Julai 2024

| Pilihan A:• Pulangan tunai 0.25% terhad kepada RM500 setiap bulan • Tempoh pembayaran balik tanpa faedah 26 hari |

Pilihan B:• Rebat Tunai 13% untuk Faedah Dibayar • Tempoh pembayaran balik tanpa faedah 20 hari |

Kemudahan Lain

- Tiada akses percuma ke travel lounge

- Utama: RM438 (Liabiliti Persendirian); Tiada Caj (Liabiliti Korporat)

- Penama/Tambahan: RM188 (Kedua-dua Liabiliti Persendirian dan Liabiliti Korporat)

Lembaran Maklumat Produk Kad Kredit Perniagaan turut dikemaskini dan akan berkuat-kuasa mulai 1 Julai 2024.

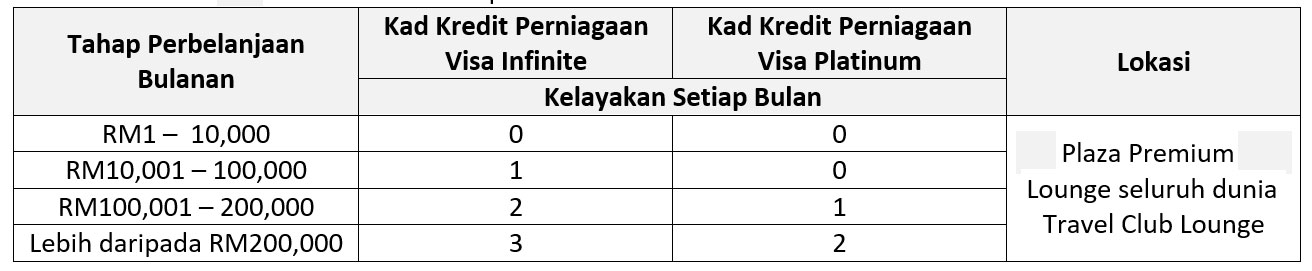

Klausa sedia ada

Akses Lounge Percuma

- Akses Lounge Percuma adalah berkenaan untuk Pemegang Kad Kredit Perniagann Visa Infinite, Kad Kredit Perniagaan Visa Platinum dan Kad Kredit Perniagaan Mastercard Platinum.

- Butiran Akses Lounge Percuma adalah seperti berikut:

- Akses Lounge Percuma terhad sebanyak 9 kali di Plaza Premium Lounge and 9 kali di Travel Club Lounge dalam tempoh satu tahun kalendar untuk Kad Kredit Perniagaan Visa Infinite

- Akses Lounge Percuma terhad sebanyak 6 kali di Plaza Premium Lounge and 6 kali di Travel Club Lounge dalam tempoh satu tahun kalendar untuk Kad Kredit Perniagaan Visa Platinum

- Pemegang Kad boleh membawa ke hadapan kelayakan yang tidak digunakan ke bulan-bulan seterusnya, tertakluk kepada had yang berkenaan untuk tahun kalendar tersebut.

- Sekiranya Pemegang Kad telah menggunakan kelayakan tetapi tidak mencapai tahap perbelanjaan bulanan (berdasarkan baki penyata bulan tersebut) dan/atau melebihi had yang diperuntukkan bagi tahun kalendar tersebut, pihak Bank akan mengenakan caj USD30 setiap kali masuk Plaza Premium Lounge dan/atau RM131 setiap kali masuk Travel Club Lounge. Caj ini akan ditunjukkan di penyata Pemegang Kad dalam tempoh masa 2 kitaran penyata dari tarikh penggunaan akses lounge tersebut.

5. Apakah yuran dan caj yang perlu saya bayar?

Klausa baharu berkuat-kuasa mulai 1 Julai 2024.

Akses Lounge Percuma

- Akses Lounge Percuma adalah berkenaan untuk Pemegang Kad Kredit Perniagaan Visa Infinite dan Kad Kredit Perniagaan Visa Platinum sahaja. <.li>

- Butiran Akses Lounge Percuma adalah seperti berikut:

- Akses Lounge Percuma terhad sebanyak 9 kali di Plaza Premium Lounge and 9 kali di Travel Club Lounge dalam tempoh satu tahun kalendar untuk Kad Kredit Perniagaan Visa Infinite

- Akses Lounge Percuma terhad sebanyak 6 kali di Plaza Premium Lounge and 6 kali di Travel Club Lounge dalam tempoh satu tahun kalendar untuk Kad Kredit Perniagaan Visa Platinum

- Pemegang Kad boleh membawa ke hadapan kelayakan yang tidak digunakan ke bulan-bulan seterusnya, tertakluk kepada had yang berkenaan untuk tahun kalendar tersebut.

- Sekiranya Pemegang Kad telah menggunakan kelayakan tetapi tidak mencapai tahap perbelanjaan bulanan (berdasarkan baki penyata bulan tersebut) dan/atau melebihi had yang diperuntukkan bagi tahun kalendar tersebut, pihak Bank akan mengenakan caj USD30 setiap kali masuk Plaza Premium Lounge dan/atau RM131 setiap kali masuk Travel Club Lounge. Caj ini akan ditunjukkan di penyata Pemegang Kad dalam tempoh masa 2 kitaran penyata dari tarikh penggunaan akses lounge tersebut.

5. Apakah yuran dan caj yang perlu saya bayar?

Terima kasih.